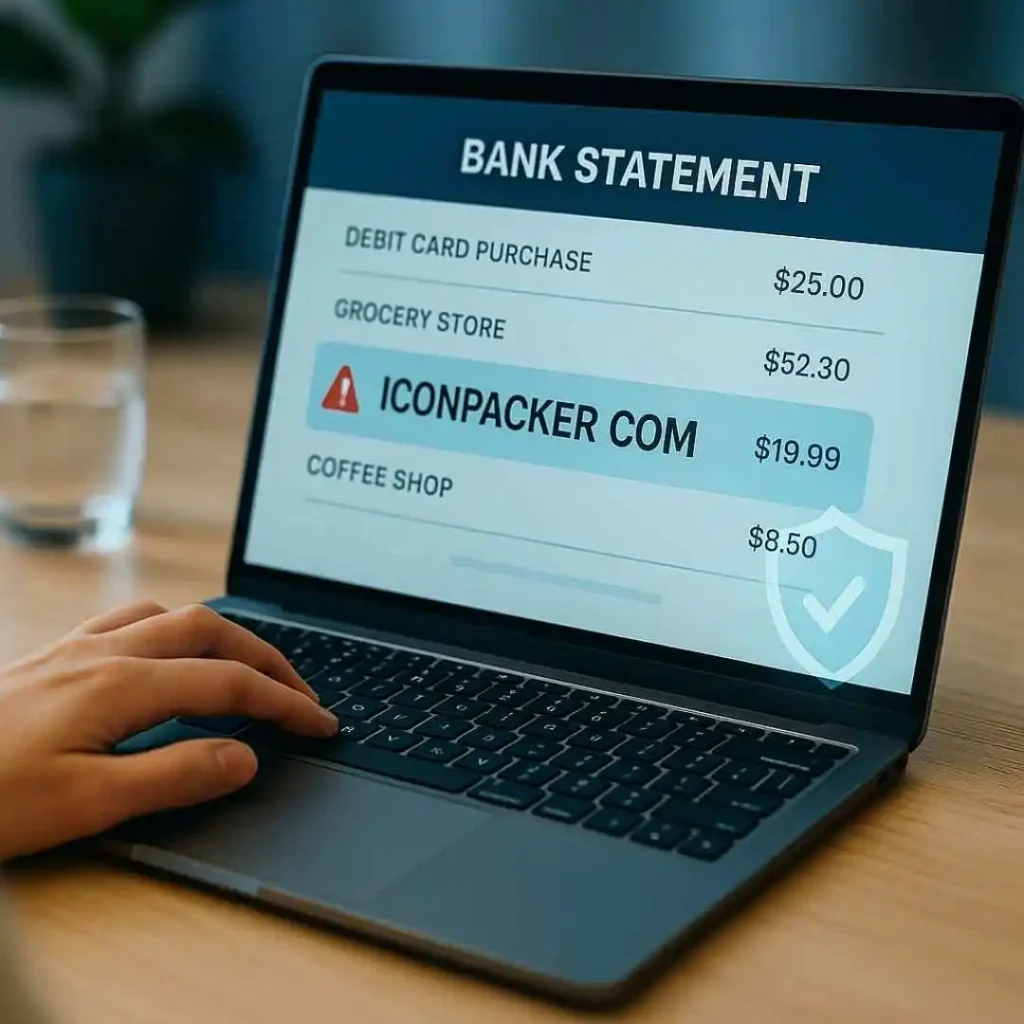

Seeing an unfamiliar “ICONPACKER COM” charge on your credit card statement can be confusing and concerning, especially if you do not remember buying anything related to icons or digital products. Many users encounter small online charges that are difficult to identify because card-not-present transactions often show shortened or unclear merchant names. This guide explains what the iconpacker com charge on credit card usually means, why it appears, how to determine whether it is legitimate or fraudulent, and the exact steps to verify or dispute it safely.

What is ICONPACKER COM?

ICONPACKER COM typically refers to an online merchant associated with digital icon packs, design assets, or downloadable graphic products. The charge often appears on credit card statements as an online card-not-present transaction. For some users, the charge is connected to a genuine purchase of digital design resources. For others, it may appear unexpectedly, especially if they do not recall visiting any related website or buying digital assets. Because online billing descriptors vary, ICONPACKER COM may represent either a legitimate transaction or an unrecognized, unauthorized charge.

How ICONPACKER COM charge appears on your credit card statement

The iconpacker com charge on credit card can display under multiple descriptor variations depending on the payment processor, location, or subscription type. Users often report entries such as ICONPACKER COM, ICONPACKER.COM, ICONPACKER SERVICE, ICONPACKER CHARLOTTE NC, ICONPACKER DIGITAL, ICONPACKER SUBSCRIPTION, or ICONPACKER followed by a phone number. These variations still point to the same merchant category. The charge may appear as small amounts like a few dollars, sometimes even lower test amounts used to verify whether a card number is active before larger unauthorized transactions occur.

Why ICONPACKER COM charge appears on your credit card

Many iconpacker.com charge cases have legitimate explanations. A user may have purchased digital icons, UI elements, or design files without noticing the merchant descriptor shown on the bank statement. Some online design bundles and asset libraries also process payments using this name. An authorized user, such as a spouse, child, or coworker with access to the card, might have made the transaction for a project or work-related material.

There are also suspicious explanations. Card details stored on a low-security website can be misused later for small online purchases. Fraudsters sometimes run small digital transactions to test whether a card is valid. Unknown recurring subscriptions may also trigger repeated iconpacker.com charges if the card information was added to an online platform without proper verification.

Is ICONPACKER COM charge legit or fraud?

Whether the iconpacker com charge on credit card is legitimate depends on the cardholder’s recent activity. A legitimate scenario includes purchasing digital icons or software-related assets where the user forgets the exact name of the website. Another legitimate example is when a family member or colleague used the card for a design-related purchase.

In a questionable scenario, a cardholder may see an $8.95 ICONPACKER COM charge and not remember buying anything. In another example, a user may notice repeated small charges that do not align with any subscription. Small, unrecognized online charges are often early signs of unauthorized card testing. While not every unrecognized charge is fraud, any charge that cannot be verified should be treated seriously to protect the account.

How to verify if the ICONPACKER COM charge is genuine

If the iconpacker.com charge appears and you are unsure whether it is valid, follow this verification checklist:

- Check your email for receipts:- Search for “Iconpacker,” “icon pack,” “receipt,” or “digital download” in your inbox and spam folder. If a matching invoice exists, the charge is likely genuine.

- Review your recent online activity:- Check your browser history for design or digital asset websites visited around the date of the charge. This often helps identify forgotten purchases.

- Check app store or subscription purchases:- Some digital tools or apps process payments using different merchant names. Review your in-app purchase history to confirm.

- Ask other authorized users:- Ask your spouse, children, or colleagues who use your card whether they purchased any design-related items.

- Look for other small unknown charges:- Scan your recent transactions. Multiple low-value entries or strange merchants can indicate unauthorized card activity.

- Check if your card is saved on design-related sites:- Stored card details on low-trust websites can trigger renewals or add-on charges.

- Identify the merchant through their site:- If possible, check the merchant’s site or support page to see if your email matches any order (without sharing full card information).

- Make your decision:- If you recognize the activity, the charge is legitimate. If nothing matches, treat the iconpacker unauthorized charge as suspicious and proceed to dispute steps.

How to dispute ICONPACKER COM charge with your bank or card issuer

If the charge remains unrecognized, follow these steps to dispute it safely:

- Lock or freeze your card immediately:- Use your banking app or call customer service to freeze the card. This prevents new unknown credit card charges while you handle the issue.

- Gather transaction details:- Note the date, amount, and exact line that appears on your statement, such as “ICONPACKER COM” or “ICONPACKER.COM.”

- Contact your bank or card issuer:- Call the number on the back of your card or use secure in-app support. Clearly state that the iconpacker com charge on credit card is unauthorized.

- Explain that the charge is not recognized:- Confirm that you have checked with all authorized users and no one made this purchase.

- Request a dispute or chargeback:- Ask the bank to start a dispute for an unauthorized credit card charge. Follow their instructions for verification or documentation.

- Request a new card number:- Ask for a replacement card to prevent further fraudulent attempts using the compromised card details.

- Monitor your account throughout the investigation:- Banks often issue temporary credit while reviewing the claim. Watch for updates and ensure no additional suspicious charges appear.

- Update legitimate services with your new card:- After receiving the new card, update only trusted merchants and subscriptions.

Legit vs suspicious scenarios

| Scenario Type | Description |

|---|---|

| Legit case | You purchased digital icons or assets and the amount matches. |

| Legit case | An authorized family member or coworker confirms they made the purchase. |

| Suspicious case | You never bought icons or design files and no one recognizes the charge. |

| Suspicious case | Several small ICONPACKER COM charges appear unexpectedly. |

Read Also:- Hubwf App Charge on Credit Card

FAQs

Is the ICONPACKER COM charge always a scam?

No. Sometimes it is a legitimate payment for digital design assets. It becomes suspicious only when you cannot match it to any activity.

What should I do if I see a small ICONPACKER test charge?

Lock your card immediately and contact your bank. Small test charges often indicate that someone is checking whether your card is active.

Can I get a refund for unauthorized ICONPACKER COM charges?

Yes. Unauthorized charges are typically refundable through your bank’s dispute or chargeback process.

Will disputing this charge harm my credit score?

No. Disputing an unauthorized credit card charge does not affect your credit score in any way.

Conclusion

The ICONPACKER COM charge can either be a valid digital asset purchase or an indication of unauthorized card use. By reviewing your online activity, checking receipts, and asking authorized users, you can confirm whether it belongs to you. When no activity matches, treat it as an unknown credit card charge and dispute it promptly. Taking preventive steps such as using virtual cards, monitoring statements, and enabling alerts helps protect your account and reduces the chance of facing similar unauthorized charges in the future.

Emma Rose is a U.S.-based personal finance writer and a regular contributor at Cardix.us. She focuses on topics like credit cards, credit scores, and everyday money management. Emma’s writing makes complex financial concepts simple and practical, helping readers make smarter credit and spending decisions with confidence.