The warmtech charge on credit card is a descriptor that may appear when a payment is processed through a third-party billing company, subscription platform, or digital service provider. Public information about this descriptor is limited, which makes it confusing for many cardholders. In most cases, Warmtech acts as a payment processor for online services, recurring memberships, digital content, or subscription-based platforms. Because the billing processor name often differs from the brand where the customer subscribed, users may not immediately recognize this charge. Understanding where this charge comes from is the first step toward confirming whether it is legitimate or unauthorized.

How “Warmtech” charge appears on your credit card statement

The warmtech charge on statement may appear in several forms depending on the merchant, region, and payment processor used. Common variations include:

- WARMTECH CYPRUS CY

- WARMTECH

- WARMTECH.NET

- WARMTECH SERVICES

- WARMTECH PAYMENT

- WARMTECH TRANSACTION

These variations occur because the billing processor name is often different from the actual website or service you used. This is a common practice in global online payments. Small formatting differences—extra words, uppercase letters, or location tags—do not change the meaning. If you see any form of “Warmtech” on your credit card statement, it is referring to the same payment processor.

Why Warmtech charge appears on your credit card

There are several realistic reasons why the warmtech credit card charge may appear:

- Online purchases:- You may have bought a digital product, service, or membership, and the merchant uses Warmtech as its billing processor.

- Subscription converted from a free trial:- Many online platforms offer free trials that automatically convert into paid plans. When renewal occurs, the Warmtech descriptor may appear instead of the website name.

- Digital content or membership:- Some platforms offering premium content, online communities, or additional features use Warmtech for recurring billing.

- Family member purchase:- Someone in your household who has access to the card may have used it for online services without informing you.

- Auto-renew billing:- Subscriptions that you signed up for months ago may renew automatically, causing the charge to appear unexpectedly.

- Old or forgotten subscriptions:- If you signed up for a service long ago, you may not remember it. Unknown credit card charges commonly come from long-unused subscriptions.

Users often fail to recognize these charges because the billing descriptor is different from the brand they interacted with. This mismatch leads to confusion and the assumption that the charge is unauthorized.

Is Warmtech charge legit or fraud?

The warmtech charge on credit card can be either legitimate or unauthorized. The difference depends on your usage history.

Legit scenarios include:

- A valid subscription you knowingly signed up for.

- A digital service that uses Warmtech as a payment processor.

- A recurring membership you joined and forgot about.

- A purchase made by a family member using your card.

Fraud scenarios include:

- You never signed up for any related service.

- You notice multiple charges within a short period.

- The location appears as Cyprus or another unfamiliar region.

- The amount appears as small repeated transactions.

- You received no email receipt or confirmation.

Many cardholders report seeing “WARMTECH CYPRUS CY” without recalling any related subscription. For example, a user may check their statement and find a $29.99 charge labeled “WARMTECH CYPRUS CY” despite not using any platform that would bill this way. In such cases, verification is necessary before assuming legitimacy.

How to verify if the Warmtech charge is genuine (step-by-step)

Use this practical verification checklist to confirm the source of the warmtech transaction:

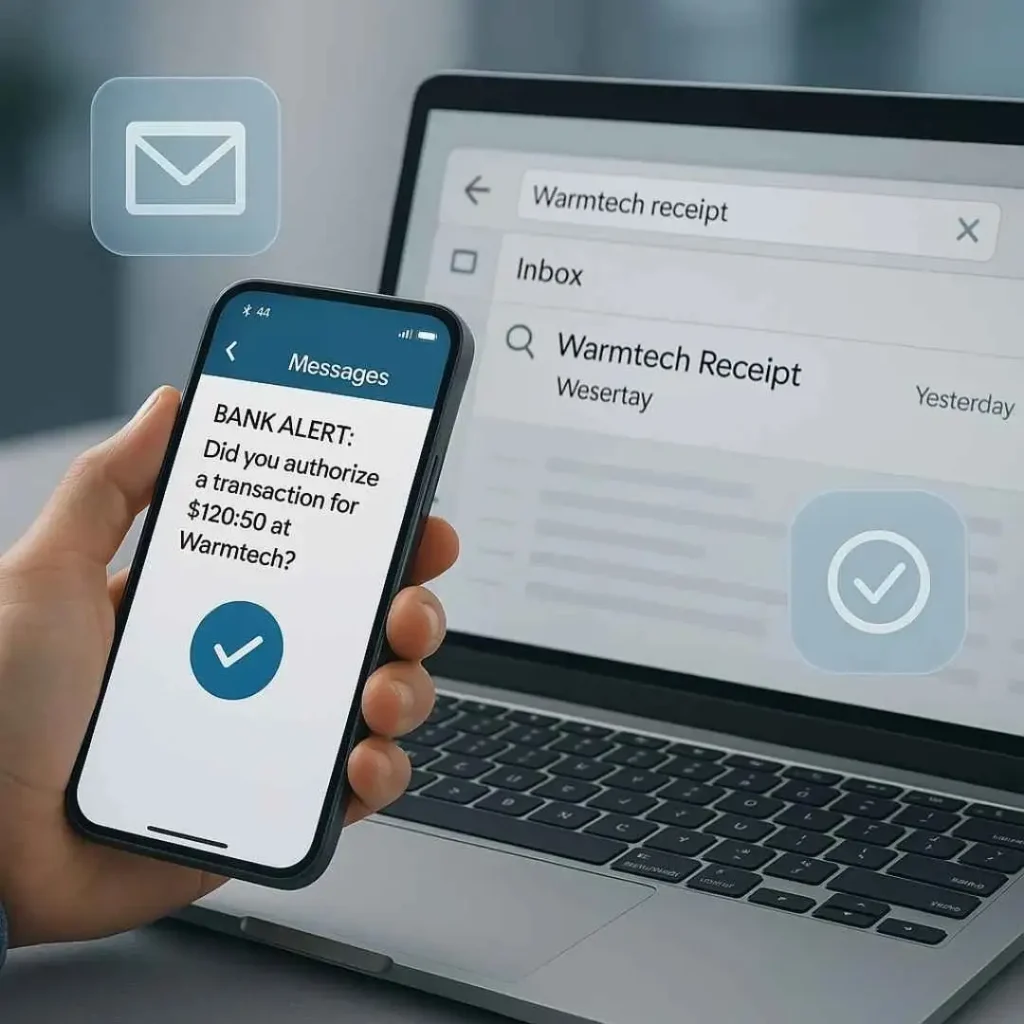

Search your email inbox

Look for keywords: “Warmtech”, “subscription”, “receipt”, “membership”, “payment confirmation”.

Check SMS and banking alerts

Banks sometimes include merchant info or website names in transaction notifications.

Review App Store or Google Play subscriptions

Many apps renew through external billing partners.

Check:

- iPhone: Settings → Apple ID → Subscriptions

- Android: Play Store → Profile → Payments & Subscriptions

Review recent online activity

- Think about whether you signed up for:

- Online tools

- Membership sites

- Content platforms

- Free trials

- Digital downloads

Ask family members

Anyone with access to your card might have signed up for a service.

Check transaction amount and pattern

Single charge = typical subscription

Repeated charges = possible unauthorized use

Visit Warmtech-related website (if you know which service used it)

Log in and check billing history or payment settings.

If none of the checks match → Treat it as potentially unauthorized

In such cases, proceed with dispute steps immediately.

How to dispute Warmtech charge with your bank or card issuer

If you determine that the warmtech payment is unauthorized, follow these steps:

Contact your bank immediately

Use the number on the back of your card or your bank’s app.

Provide transaction details

Share:

- The descriptor (“Warmtech” or variation)

- Transaction date

- Amount

- A statement that you did not authorize it

Ask the bank to start a dispute or chargeback

Most banks begin an investigation right away. They may provide a temporary credit during review.

Request the card to be blocked if fraud is suspected

If the card information is compromised, the bank will issue a new card.

Follow the bank’s timeline

Investigation times vary but typically range from a few days to a few weeks depending on the card issuer.

Sample script you can say:

“Hi, I see a ‘warmtech charge on my credit card’ that I did not authorize. Please start a dispute, block future charges, and issue a new card if needed.”

Legit vs suspicious scenarios

| Legit Scenario | Suspicious Scenario |

|---|---|

| You recognize the service | You never visited or used related service |

| Receipt or invoice available | No receipt or email at all |

| Single subscription charge | Multiple repeated charges |

| Amount matches known plan | Unusual or random recurring amounts |

| Familiar website or app | Unknown foreign location like Cyprus |

Read Also:- LIVENX Charge on Credit Card

FAQs

Is the warmtech charge on credit card a scam?

Not always. It may be a legitimate subscription or digital service billed through a third-party processor. If you cannot identify it, treat it as suspicious.

Why did I receive a warmtech payment without remembering any purchase?

You may have an active subscription, free trial conversion, or an old forgotten membership. If none match, it may be unauthorized.

How do I stop Warmtech from charging my card?

Identify the related service and cancel the subscription. If the charge is unknown, dispute it with your bank and request a card replacement.

Can I dispute a Warmtech transaction?

Yes. If the charge is unrecognized or unauthorized, your bank can help you file a dispute and block future charges.

Conclusion

The warmtech charge on credit card generally refers to a payment processed through a digital platform, subscription service, or third-party billing system. Some charges are legitimate, while others may be unauthorized. Always verify the source through email receipts, subscriptions, and app activity. If the payment is unfamiliar, dispute it immediately and secure your card. With careful monitoring and preventive habits, you can avoid unknown or unauthorized charges in the future and keep your financial information safe.

Emma Rose is a U.S.-based personal finance writer and a regular contributor at Cardix.us. She focuses on topics like credit cards, credit scores, and everyday money management. Emma’s writing makes complex financial concepts simple and practical, helping readers make smarter credit and spending decisions with confidence.