Have you ever wondered, “Is using someone else’s credit card a felony?” It’s a question that pops up for many people, especially in situations where a quick borrow seems harmless. But unauthorized credit card use can lead to serious legal trouble in the United States, depending on the circumstances. Whether you’re a young adult who grabbed a parent’s card for an online purchase or someone dealing with a friend who used yours without asking, understanding the law is crucial.

In this guide, we’ll break down when using someone else’s credit card crosses into felony territory, the differences between misdemeanor and felony fraud, and the potential consequences like fines or jail time. We’ll also cover exceptions, such as when permission is given, and practical steps to protect yourself. By the end, you’ll have a clear picture of credit card misuse criminal charges and how to avoid them. Let’s dive in to help you stay on the right side of the law.

Is Using Someone Else’s Credit Card a Felony?

The short answer to “is using someone else’s credit card a felony” is: it can be, but it depends on factors like the amount involved, your intent, and where it happens. Credit card fraud isn’t always a federal crime, but it often falls under state laws treating it as theft or fraud. Federal involvement kicks in if the fraud affects interstate commerce, like using a stolen card across state lines.

Unauthorized Use and Criminal Fraud Definitions

Unauthorized credit card use law defines fraud as knowingly using a credit card, debit card, or card number without the owner’s permission to obtain goods, services, or money. This includes physical theft, skimming numbers, or even using a family member’s card without consent. Criminal fraud requires intent to deceive or defraud—accidental use, like mistaking cards, usually isn’t charged. For example, using a friend’s credit card without permission could be seen as fraud if you knew it wasn’t okay.

Federal law under 15 U.S. Code § 1644 makes fraudulent use a crime if it involves more than $1,000 in a year, but most cases are handled at the state level. States like New York treat stealing a card as an automatic felony, regardless of use.

How Dollar Amount and Intent Determine Felony Status

The dollar amount is a big factor in felony vs misdemeanor credit card theft. In many states, small amounts lead to misdemeanor charges, while higher values escalate to felonies. Intent matters too—if prosecutors can prove you meant to steal or defraud, charges stick harder. For instance, a one-time low-value purchase might be a misdemeanor, but repeated uses showing a pattern could push it to felony credit card fraud.

When Does Unauthorized Credit Card Use Become a Felony?

Unauthorized use becomes a felony based on state-specific rules, often tied to the value of what’s obtained. Credit card theft a felony? Yes, if it meets certain thresholds or involves aggravating factors like multiple cards or victims.

Felony Theft Thresholds by State

Felony thresholds vary widely across the U.S. Here’s a quick overview of some common ones:

- California: Over $950 in value is typically a felony.

- Florida: Theft over $750 can be a felony; credit card fraud over $300 with multiple victims is second-degree.

- Illinois: Purchases over $300 can lead to a Class 3 felony.

- New York: Stealing the card itself is a Class E felony.

- Texas: Theft must exceed $2,500 for felony status.

- Virginia: Credit card fraud over a certain value (often $200-$500) becomes a felony.

Check your state’s laws, as thresholds can change and some treat all credit card misuse as felonies if intent is proven.

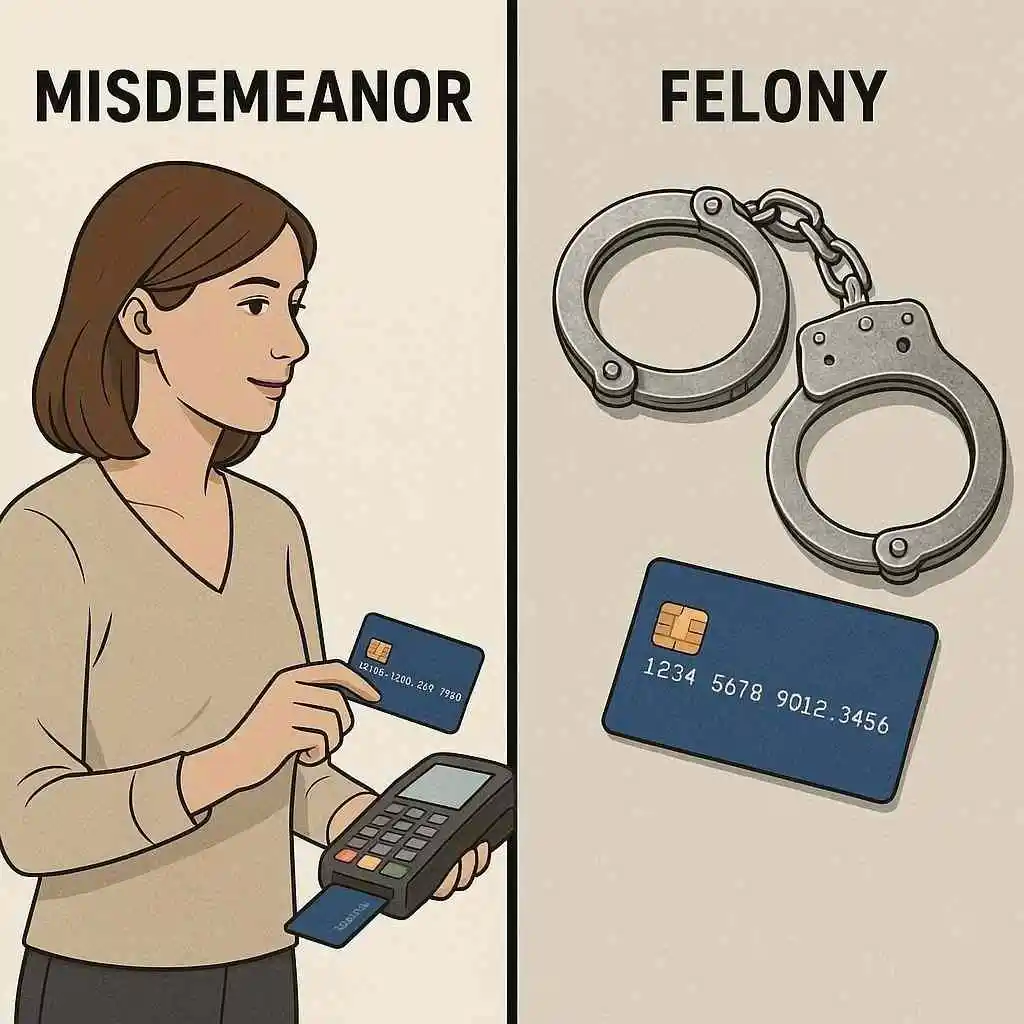

Misdemeanor vs Felony Penalties

The key difference between misdemeanor and felony credit card fraud is severity. Misdemeanors are lesser crimes, often for low-value fraud (under $500-$1,000), with penalties like up to one year in jail and fines up to $1,000-$5,000. Felonies, for higher amounts or repeat offenses, can mean 1-15 years in prison and fines up to $10,000 or more. Some states use “wobbler” offenses, where prosecutors decide based on circumstances.

Legal Consequences of Credit Card Fraud

Facing charges for using someone else’s credit card? The legal consequences of using someone else’s card can be life-altering, from immediate penalties to long-term effects.

Fines, Jail Time, Probation

Fines range from $500 for misdemeanors to $10,000+ for felonies. Jail or prison time varies: misdemeanors up to 1 year, felonies 1-10 years or more federally. Probation might be an option for first-timers, involving community service or restitution to victims. Federal cases can add up to 15 years if identity theft is involved.

Criminal Record and Long-Term Impact

A conviction creates a criminal record, making it hard to get jobs, loans, or housing. It can also lead to loss of professional licenses or immigration issues. Long-term, you might face higher insurance rates or difficulty traveling.

Are There Any Exceptions?

Not every case of using someone else’s credit card is a felony—or even illegal. Exceptions exist based on permission, relationships, and other factors.

Cases Where Permission Was Given

If the card owner gives explicit permission, it’s not fraud. Adding someone as an authorized user avoids issues. But verbal okay isn’t always enough—get it in writing if possible.

Situations Involving Family or Minors

Using a family member’s card without permission is still fraud, but families often resolve it privately without pressing charges. For minors, charges are rare for using a parent’s card, handled in juvenile court if pursued. Parents might be liable for charges if the child is under 18.

Proving Intent in Court

Prosecutors must prove intent to defraud. If you believed you had permission or it was a mistake, that could be a defense. Evidence like texts or history of shared use helps.

How to Protect Yourself or Respond to Charges

Worried about credit card misuse? Here’s a practical guide:

- Seek legal counsel immediately: Contact a criminal defense attorney specializing in fraud to understand your options and build a defense.

- Gather evidence: Collect receipts, communications, or statements showing permission or lack of intent.

- Contact the credit card company: Report unauthorized use quickly—under federal law, your liability is limited to $50 if reported promptly.

- Avoid future misuse: Always get written permission, use your own cards, and monitor statements to prevent issues.

FAQ Section

Is it illegal to use someone else’s card with their permission?

No, if permission is given, it’s not fraud. Consider becoming an authorized user for clarity.

What if I didn’t know it was wrong?

: Ignorance isn’t a full defense, but lack of intent can reduce charges. Courts look at whether you reasonably believed it was okay.

Can a minor be charged with felony credit card fraud?

Yes, but it’s uncommon for family cases and often handled in juvenile court starting around age 12-13, depending on the state.

How much money makes it a felony?

It varies by state—often $500-$2,500 or more. For example, over $950 in California or $750 in Florida can trigger felony charges.

In summary, is using someone else’s credit card a felony? It often is if unauthorized and over state thresholds, with serious legal consequences like prison time and fines based on amount and intent. Always get permission to avoid trouble, and if facing charges, seek help fast. Staying informed protects you and your finances—knowledge is your best defense against credit card misuse laws.

Emma Rose is a U.S.-based personal finance writer and a regular contributor at Cardix.us. She focuses on topics like credit cards, credit scores, and everyday money management. Emma’s writing makes complex financial concepts simple and practical, helping readers make smarter credit and spending decisions with confidence.