Credit card use is second nature in America, but when someone crosses the line into fraud or misuse, the law takes it seriously. In Texas, “credit card abuse” is more than just running up debt—it’s a specific criminal offense with penalties that can change someone’s life. If you’ve ever wondered whether credit card abuse is a felony in Texas, the answer is yes, in most cases it is. Let’s break down what that means, how the law defines it, and what the real-world consequences look like.

What Texas Law Says About Credit Card Abuse

Under Texas Penal Code §32.31, credit card abuse covers a wide range of actions. It’s not just about stealing a card—it includes knowingly using someone else’s card without permission, trying to buy something with a canceled or fake card, or even selling credit card numbers.

Key ways Texas defines credit card abuse:

- Using someone else’s card without consent

- Buying items with a fake, stolen, or expired card

- Possessing card numbers with intent to use them fraudulently

- Selling or transferring card information unlawfully

Example: Imagine someone finds a lost Visa card at a grocery store and decides to pay for gas with it. Even if they only spend $40, Texas law treats it as a crime of credit card abuse.

Is Credit Card Abuse a Felony in Texas?

Yes. By default, Texas categorizes credit card abuse as a state jail felony. That puts it in the same class as certain theft or drug possession charges.

What does a state jail felony mean?

- Jail Time: Between 180 days and 2 years in a state jail facility

- Fines: Up to $10,000

- Permanent Record: A felony conviction stays on record, making jobs, housing, and credit harder to secure

The penalties can increase depending on who the victim is. For instance:

- If the crime targets an elderly individual, it becomes a third-degree felony, which carries 2–10 years in prison.

Example: A scammer uses the credit card of a senior citizen at a pharmacy to buy gift cards. Because the victim is elderly, prosecutors can push for third-degree felony charges, not just a state jail felony.

Why Texas Treats Credit Card Abuse as a Felony

Unlike minor theft, credit card abuse often involves deception, technology, and broader financial impact. Lawmakers see it as a crime that can ripple beyond one victim—banks, businesses, and even the overall trust in digital payments are at stake.

Example: A group of college students decides to “borrow” a classmate’s card details to order pizza online. To them, it feels like a prank. To the law, it’s a felony-level fraud scheme.

Real-World Consequences Beyond Jail Time

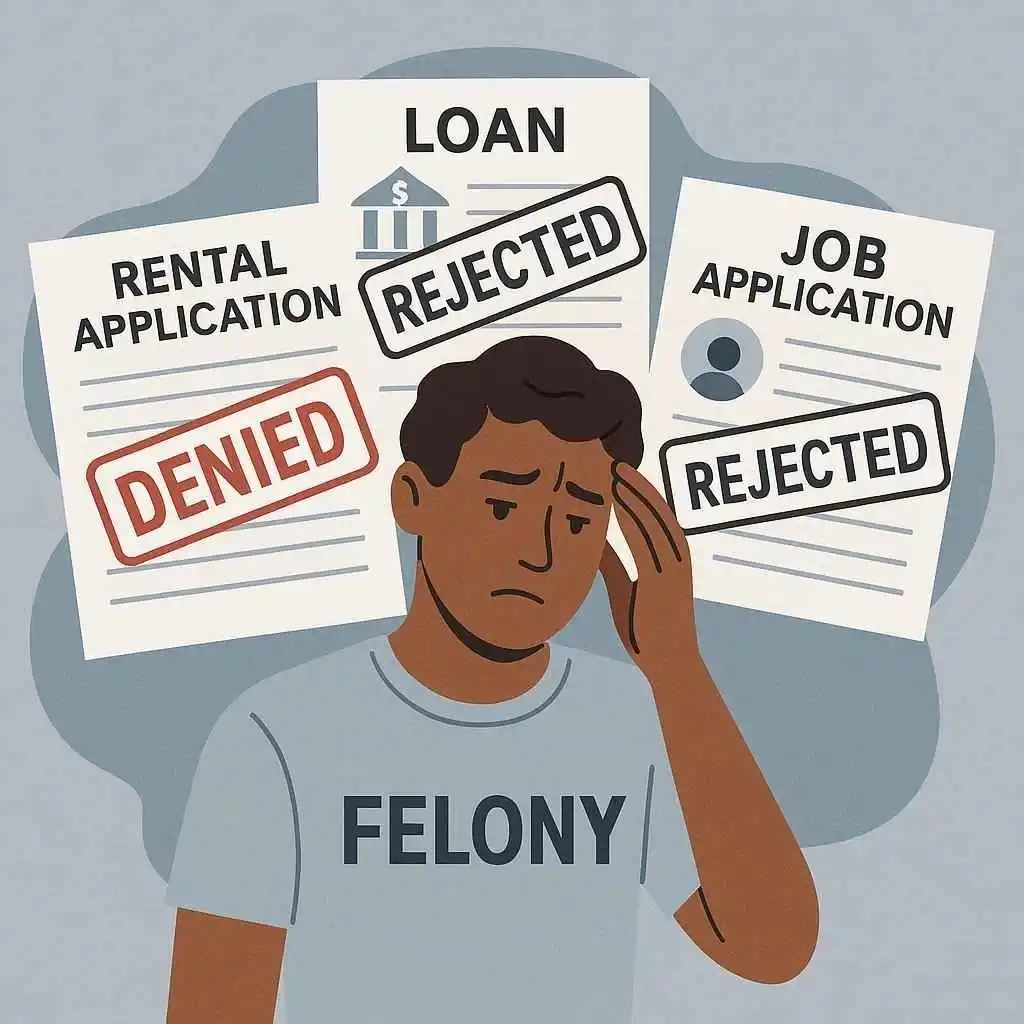

Even if someone avoids jail through probation, a felony record brings lifelong consequences.

Collateral impacts of a credit card abuse conviction:

- Employment: Many employers run background checks and avoid hiring felons, especially in jobs handling money.

- Housing: Landlords may reject rental applications due to a felony record.

- Credit & Loans: Banks are cautious about lending to someone with a financial crime conviction.

- Professional Licenses: Nurses, teachers, and other licensed professionals may lose or be denied licenses.

Example: A young adult charged with credit card abuse avoids jail by completing probation. Later, when applying for a banking job, the felony shows up in the background check and costs them the opportunity.

Credit Card Abuse vs. Simple Debt Problems

It’s important to distinguish between being in debt and credit card abuse. Missing payments, maxing out cards, or being unable to pay bills is not a crime. That falls under civil law and impacts credit scores—not criminal law.

Credit card abuse, on the other hand, involves intentional fraud or misuse.

Quick comparison:

- Debt Trouble → Late fees, collections, credit score damage (civil matter)

- Credit Card Abuse → Fraudulent activity like using someone else’s card (criminal matter, felony)

Example: John loses his job and falls behind on his credit card payments. He faces collection calls and damaged credit but not criminal charges. Meanwhile, his neighbor uses a stolen card at a gas station—an act that triggers felony prosecution.

How Texas Prosecutors Handle These Cases

Prosecutors in Texas often rely on digital evidence—transaction records, surveillance footage, and card reader logs. Even small transactions can leave a clear trail.

Common defense strategies include:

- Lack of intent: Arguing the person didn’t know the card was stolen or expired.

- Mistaken identity: Proving the defendant wasn’t the one using the card.

- Consent: Showing that the cardholder authorized the use.

Example: A man buys groceries with his roommate’s card, claiming he had verbal permission. If the roommate later denies it, the defense may argue consent was given to avoid a felony conviction.

Preventing Credit Card Abuse Charges

Sometimes, what feels like a small shortcut can spiral into a felony charge. Prevention comes down to respecting card ownership and being careful with information.

Tips to stay safe:

- Never use someone else’s card unless you have clear permission.

- Avoid “borrowing” card numbers even for minor purchases.

- Be cautious about buying discounted gift cards or items online—many come from stolen card scams.

Example: Sarah sees a “too good to be true” ad for cheap electronics online. She buys one, only to discover it was purchased using stolen credit card information. Police trace the transaction, and Sarah faces investigation despite thinking she was just a buyer.

What To Do If You’re Accused of Credit Card Abuse

Being charged doesn’t always mean a conviction. Texas courts consider circumstances, prior history, and available evidence.

Possible outcomes:

- Dismissal: If evidence is weak.

- Reduced Charges: Prosecutors may offer plea deals, sometimes lowering a felony to a misdemeanor.

- Probation or Diversion: First-time offenders may qualify for probation or alternative programs.

Example: A college student charged with credit card abuse for using a friend’s card once might receive probation and community service rather than a prison sentence—if the friend confirms it wasn’t malicious theft.

Read Also- Credit Card or Debit Card Abuse Charge: What You Need to Know in the U.S.

FAQs: Credit Card Abuse in Texas

Is every case of credit card abuse in Texas a felony?

Yes, Texas law makes credit card abuse a state jail felony by default, though penalties can escalate to third-degree felony if the victim is elderly.

Can someone go to prison for just one unauthorized purchase?

Absolutely. Even a single $20 purchase with a stolen card can qualify as credit card abuse and lead to felony charges.

What’s the difference between theft and credit card abuse?

Theft usually involves taking physical property, while credit card abuse specifically targets the misuse of cards or account information. Both can be felonies, but credit card abuse has its own statute in Texas.

Can a conviction be expunged or sealed?

In most cases, felony convictions cannot be expunged. Some deferred adjudications may be eligible for nondisclosure, but eligibility depends on the case.

Does using a family member’s card count as credit card abuse?

If you use a spouse’s or parent’s card with permission, it’s not abuse. But without explicit consent, even within families, it can still be prosecuted as a felony.

Conclusion: What Texans Should Take Away

In Texas, credit card abuse is not a slap-on-the-wrist offense—it’s a felony that can reshape a person’s future. From short jail terms to lifelong collateral damage, the stakes are high. What may seem like a harmless purchase or a small shortcut can lead to serious charges. Understanding the difference between financial hardship and criminal misuse is critical, especially in a state where prosecutors take fraud seriously.

The bottom line: In Texas, credit card abuse is almost always a felony, and even small actions can have big consequences. Treat credit cards with the same caution you’d give to someone’s house keys—using them without permission isn’t just risky, it’s a crime.

Emma Rose is a U.S.-based personal finance writer and a regular contributor at Cardix.us. She focuses on topics like credit cards, credit scores, and everyday money management. Emma’s writing makes complex financial concepts simple and practical, helping readers make smarter credit and spending decisions with confidence.