Seeing a BODTIQ FANS charge on credit card can be confusing, especially when you do not recall signing up for anything with that name. Many cardholders come across unexpected subscription charges or unfamiliar transaction descriptions. This article explains what the BODTIQ FANS payment may represent, why it appears, whether it is legitimate, how to verify the charge, how to dispute it, and how to avoid similar issues in the future. The goal is to help you understand the charge clearly and take safe, practical action.

What is BODTIQ FANS?

BODTIQ FANS appears as an online subscription or membership-related billing descriptor used by certain digital platforms. When a merchant processes payments through third-party billing providers, the name on your statement may differ from the brand you remember. This is common with entertainment services, trial-based offers, or fan-content platforms. Because limited public information is available, it is often difficult for cardholders to connect the charge to a specific service. This is why the bodtiq fans charge on credit card is frequently searched online.

How “BODTIQ FANS” charge appears on your credit card statement

The descriptor usually appears in forms such as “BODTIQ FANS,” “BODTIQ.FANS,” or similar variations. The transaction may look like a recurring payment, a subscription renewal, or a small authorization followed by a full charge. Some users report noticing the charge only after several months. If someone in your household enrolled in a digital membership, the bodtiq fans transaction might come from that activity. If you do not recognize this charge at all, it may appear to be an unknown credit card charge, which requires careful review.

Why BODTIQ FANS charge appears on your credit card

The most common reasons for this type of charge are subscription renewals, free trial conversions, or sign-ups through partner websites. Many digital services use billing partners, which means the statement name may not match the site you remember. The charge might also appear if someone else with access to your card enrolled in an online service. In some cases, cardholders report unexpected renewals due to not canceling a trial on time. If none of these apply, treat the bodtiq fans charge as potentially unauthorized.

Is BODTIQ FANS charge legit or fraud?

Some users may have legitimately signed up for a digital membership but forgotten the merchant name. In such cases, the charge is genuine even if the statement descriptor looks unfamiliar. For example, a cardholder may subscribe to a content-based platform and only later realize the billing name shows as BODTIQ FANS.

However, there are also situations where the charge is not recognized by the cardholder at all. A person may check their statements, find the bodtiq fans payment, and feel concerned because they never signed up for anything. If there is no matching subscription in your email or account history, the transaction can indicate an unauthorized credit card charge. Careful verification is essential before assuming legitimacy.

How to verify if the BODTIQ FANS charge is genuine

Start by checking your recent email inbox for subscription confirmations, trial sign-ups, renewal alerts, or payment receipts. Many merchants send automated emails that help identify the service linked to the charge. Next, review digital accounts used by you or family members to see if any subscription was created using your card. If the platform has a login portal, check for active memberships tied to your email.

Then compare the date and amount of the bodtiq fans transaction with any online purchases you made. If the name still does not match, contact the merchant through their official website for clarification. If you cannot reach the merchant or cannot confirm the connection, the charge may be unauthorized. At that point, proceed with your bank’s verification process.

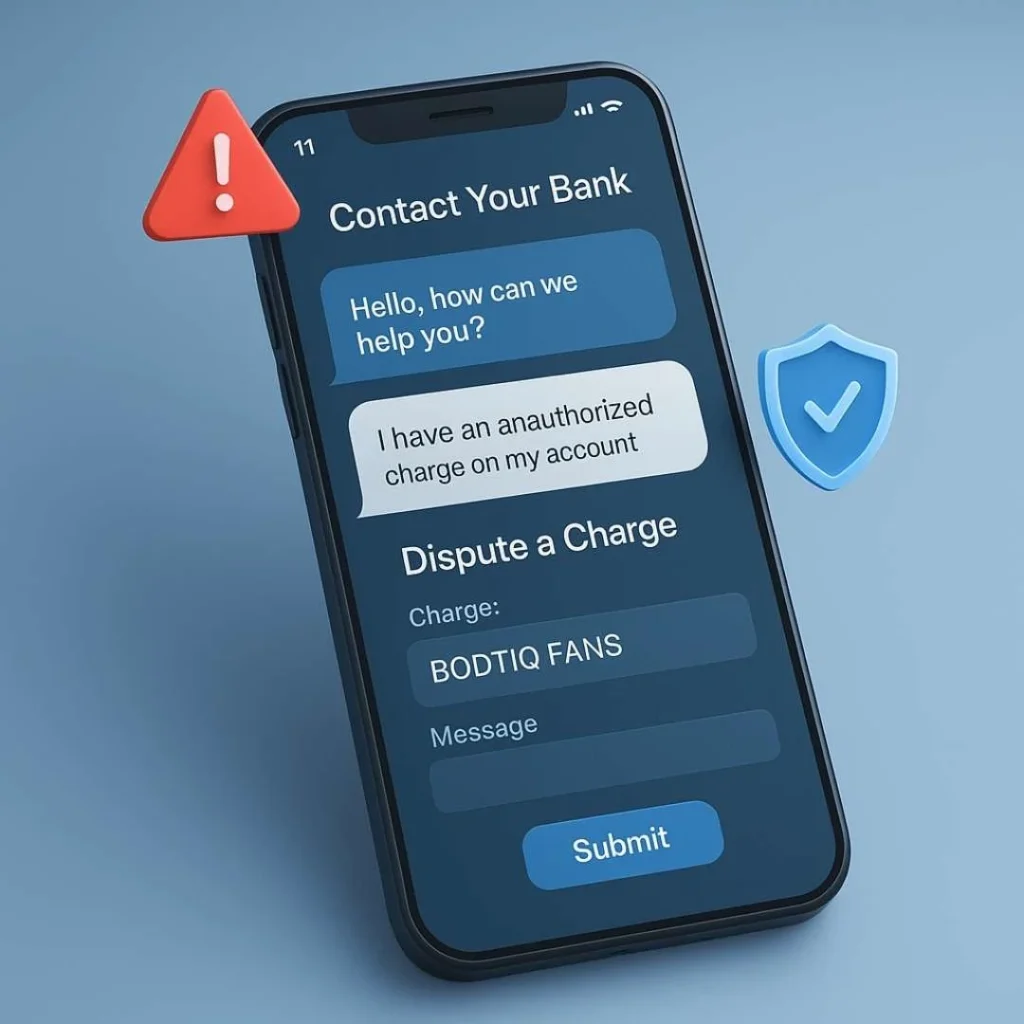

How to dispute BODTIQ FANS charge with your bank or card issuer

If the charge remains unrecognized after verification, contact your bank immediately. Explain that you are disputing a potentially unauthorized charge and provide the amount, date, and transaction description. Your card issuer will review your claim and may temporarily credit your account during the investigation. If the charge appears fraudulent, the bank will block future transactions, reverse the payment, and issue a replacement card.

If you believe the charge was due to a subscription you canceled or never received value for, ask your bank how to file a dispute credit card charge for service issues. Acting quickly increases the likelihood of a successful chargeback. Always enable transaction alerts to detect future issues faster.

Legit vs suspicious scenarios

| Scenario | Legit | Suspicious |

|---|---|---|

| You remember signing up for an online subscription | Yes | No |

| Someone in your household may have used your card | Possible | Possible |

| No matching email, receipt, or subscription found | No | Yes |

| Merchant responds with account details | Yes | No response or unclear reply |

| Charge repeats monthly without explanation | Maybe | Yes |

| Amount does not match any purchase you made | No | Yes |

Read Also:- Bamboo Print LLC Charge on Credit Card

FAQs

Why am I seeing a BODTIQ FANS charge on my credit card?

It usually appears due to a subscription, renewal, or digital service transaction. If you did not authorize it, treat it as an unknown credit card charge.

Is BODTIQ FANS a legitimate company?

It can be legitimate when tied to a valid subscription, but it may also appear in cases of unauthorized use. Verification is essential.

How do I stop BODTIQ FANS charges?

Check your accounts, attempt to cancel through the merchant, and if unsuccessful, contact your bank to block the charge.

Can the bank refund the BODTIQ FANS charge?

Yes. If the bank confirms it is an unauthorized credit card charge, they can reverse it through a dispute or chargeback.

Conclusion

Finding a bodtiq fans charge on credit card can be confusing, but understanding how these transactions work helps you take the right steps quickly. The charge may relate to a subscription, a renewal, or an accidental sign-up. If it does not match any known activity, treat it as potentially unauthorized and follow proper verification and dispute procedures. Monitoring your statements, using secure payment methods, and keeping track of your subscriptions can prevent similar issues in the future.

Emma Rose is a U.S.-based personal finance writer and a regular contributor at Cardix.us. She focuses on topics like credit cards, credit scores, and everyday money management. Emma’s writing makes complex financial concepts simple and practical, helping readers make smarter credit and spending decisions with confidence.