The airwalxhk charge on credit card is a descriptor that often appears when a payment is processed through Airwallex, a global financial technology company that provides payment solutions to international businesses. Many cardholders see this charge and feel confused because the descriptor does not clearly show the merchant name. This guide explains what the charge means, why it appears, when it is legitimate, and how to verify its origin. It also covers dispute steps and best practices to prevent unknown charges in the future.

What is Airwalxhk?

The airwalxhk charge on credit card generally represents a payment processed through Airwallex, a global payment processor used by many online merchants.

Airwallex provides payment infrastructure to businesses, especially international and digital-first companies. When a merchant uses Airwallex to process a payment, your credit card statement may show “Airwalxhk” instead of the business name you purchased from. This happens because the payment is routed through Airwallex’s system, and the billing descriptor reflects the processor rather than the storefront. This is normal behavior for many third-party payment processors.

How “Airwalxhk” charge appears on your credit card statement

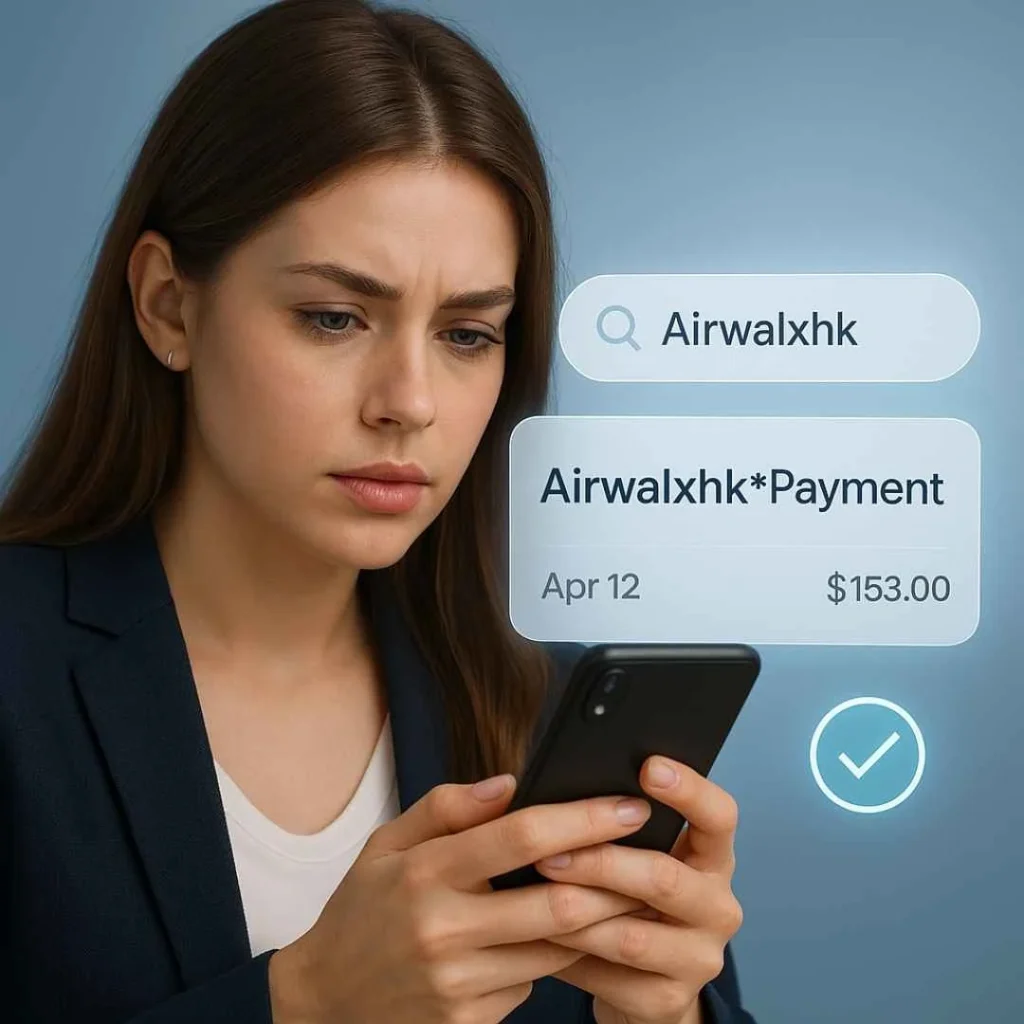

The airwalxhk payment may appear in several variations depending on the merchant, region, and issuing bank. Common forms include “AIRWALXHK*XXXX,” “AIRWALXHK HONG KONG HK,” or “AIRWALX HK.” These variations occur because billing descriptors differ across currencies, countries, and payment rails.

The date, amount, and currency may appear normally just like any other transaction, but the merchant name may be replaced or partially masked by the Airwallex descriptor. This difference can make the airwalxhk credit card charge appear unfamiliar, even when the purchase is legitimate.

Why Airwalxhk charge appears on your credit card

There are several factual and realistic reasons why an airwalxhk transaction appears on your statement.

One common reason is that you purchased something from an online store that uses Airwallex to process its credit card payments. Many international merchants, especially digital product companies, subscription platforms, and global e-commerce businesses, rely on third-party processors like Airwallex. This means the processor name shows instead of the retail brand.

Another reason is subscription billing or trial plans that renew automatically. Many apps and online tools use Airwallex as a backend processor, so renewals may show the airwalxhk charge on credit card. Digital products, software tools, educational platforms, and small international vendors are frequently linked with this type of billing descriptor.

Is Airwalxhk charge legit or fraud?

The airwalxhk charge on credit card can be legitimate or suspicious depending on your situation.

A legitimate scenario occurs when you knowingly made a purchase from a merchant using Airwallex. For example, a user buys a digital tool or subscribes to an online service and sees the charge appear as Airwalxhk instead of the brand name. Another realistic scenario is subscribing to an app trial that converts to a paid plan, leading to a charge that looks different from what the user expected.

A suspicious scenario occurs when you do not recall making any purchase that matches the amount. For example, a cardholder sees an unfamiliar airwalxhk payment without recognizing the merchant or purchase date. Repeated small charges or multiple attempts for similar amounts can also indicate unauthorized activity. When a user has never interacted with a merchant that processes payments through Airwallex, the charge should be treated as an unknown credit card charge and reviewed carefully.

How to verify if the Airwalxhk charge is genuine (step-by-step)

- Step 1: Start by checking your recent online purchases. Review all orders you placed within the last 30 to 60 days and compare the amounts. Many users forget small subscriptions or one-time purchases.

- Step 2: Search your email inbox for receipts. Use keywords such as “payment,” “receipt,” or “order confirmation.” Sometimes the merchant email confirms that the payment gateway is Airwallex.

- Step 3: Review your subscription history across all online services. Look into any apps, tools, or websites where you may have entered your card information.

- Step 4: Check your Apple Pay, Google Pay, or PayPal activity. If the card is linked to these wallets, the charge may have been routed through Airwallex.

- Step 5: Ask family members or joint card users whether they made a purchase. Many unrecognized charges turn out to be known purchases by authorized users.

- Step 6: Review your app store billing records. Digital platforms sometimes process recurring payments using third-party processors like Airwallex.

- Step 7: If the descriptor includes an identifiable merchant name or partial name, contact that merchant directly to verify the charge.

- Step 8: If the merchant cannot be identified, contact your bank. Ask them to provide merchant category code (MCC) details or payment routing information to determine whether the airwalxhk transaction is legitimate.

How to dispute Airwalxhk charge with your bank

- Step 1: Secure your card immediately if the charge appears unauthorized. This may include locking the card temporarily through your banking app or requesting a card block.

- Step 2: Call your bank’s customer service and report the unauthorized credit card charge. Provide the transaction amount, date, and descriptor exactly as it appears.

- Step 3: Submit a dispute or chargeback request if the bank determines the charge is unauthorized. You may be asked to fill out a dispute form or provide a written explanation.

- Step 4: Your bank may issue temporary credit while the dispute is under review. This depends on the card issuer’s policies and timelines.

- Step 5: The bank will investigate the transaction by contacting the payment processor or merchant. Investigations usually take a reasonable amount of time depending on the complexity of the case.

- Step 6: Continue monitoring your account for additional unknown charges. If any more suspicious amounts appear, report them immediately to prevent further misuse.

Legit vs suspicious scenarios

| Scenario | What it usually means |

|---|---|

| Known subscription renewing | Likely legitimate recurring payment |

| Recognized merchant using Airwallex | Standard Airwallex-processed purchase |

| Unexpected airwalxhk charge on credit card | Requires verification or review |

| Repeated unknown small amounts | Possibly unauthorized activity |

Read Also:- 700 N San Vicente Blvd Charge on Credit

FAQs

Why does the airwalxhk charge on credit card appear?

It appears because the merchant used Airwallex to process your payment, and the processor name shows instead of the merchant name.

Can the airwalxhk transaction be a subscription?

Yes. Many digital platforms and apps use Airwallex for recurring billing.

What should I do if I don’t recognize the airwalxhk payment?

Verify recent purchases, subscriptions, and wallet activity. If still unsure, contact your bank immediately.

How long does it take to dispute a charge?

Dispute timelines vary by bank, but most investigations take several days to a few weeks.

Conclusion

The airwalxhk charge on credit card usually appears when a payment is processed through Airwallex rather than directly by the merchant. This descriptor is common with online services, global merchants, and subscription billing. Users should always verify the charge by reviewing purchases, receipts, and wallets. If the payment is unknown or suspicious, a dispute should be filed promptly. Maintaining transaction alerts and reviewing statements regularly is the best way to prevent unauthorized charges in the future.

Emma Rose is a U.S.-based personal finance writer and a regular contributor at Cardix.us. She focuses on topics like credit cards, credit scores, and everyday money management. Emma’s writing makes complex financial concepts simple and practical, helping readers make smarter credit and spending decisions with confidence.